Brazil Travel Insurance Best Plans for 2025

Brazil Travel Insurance Best Plans for 2025

Brazil isn’t just a destination — it’s a sensory explosion. From the electric rhythm of Rio de Janeiro’s samba streets, to the Amazon’s wild heartbeat, to the warm, colorful energy of Salvador and São Paulo, Brazil pulls millions of travelers from the US, UK, Canada, and Australia every year. Yet beneath the beauty lies one truth first-time travelers often learn too late: Brazil rewards the prepared.

Brazil travel insurance isn’t just another checkbox. In Brazil, it’s your shield against expensive medical care, lost baggage during inter-city flights, sudden trip cancellations due to weather, and unexpected emergencies that can turn a dream vacation into financial stress. Many travelers underestimate how quickly costs add up—hospital care, medical evacuation from remote regions, or replacing stolen items can climb into the thousands. Even the most experienced travelers underestimate Brazil’s unique mix of natural environments, bustling cities, and high-energy activities.

This guide walks you through everything you must know to choose the best Brazil travel insurance—especially if you’re coming from top-tier travel markets (US, UK, Canada, Australia). Using real case studies, clear comparison tables, insider insights, and beginner-friendly explanations, you’ll understand exactly what you need, why you need it, and how to pick a plan that actually protects you.

By the end, you’ll feel confident, safe, and fully prepared — so Brazil becomes not just a trip, but a story worth telling.

What is brazil travel insurance for tourists

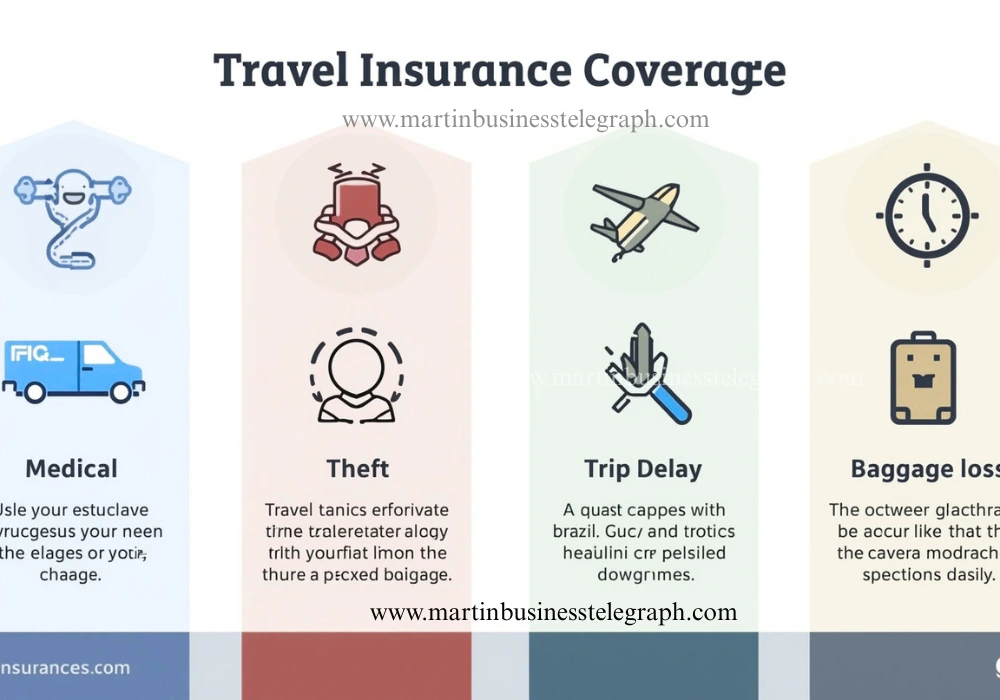

Brazil travel insurance for tourists is a specialized policy designed to protect international travelers visiting the country. It covers medical emergencies, travel delays, lost luggage, theft, adventure sports incidents, and other unexpected events that could impact your trip. While Brazil does not require travel insurance for entry, the U.S. State Department, UK FCDO, Government of Canada, and SmartTraveller Australia strongly recommend it due to Brazil’s variable safety, terrain, and medical cost considerations.

At its core, Brazil travel insurance serves three purposes:

1. Financial Protection

Brazil’s medical system is mixed — public hospitals are free, but the quality varies significantly. Private hospitals offer high-quality care but can be expensive. A simple emergency visit may cost $300–$500; more complex treatment can exceed $5,000. Travel insurance shields you from these unexpected expenses.

2. Travel Stability

Flight delays are common across Brazil’s large domestic network — especially in Rio, São Paulo, Brasília, and Recife. Travel insurance helps you recover costs for missed connections or extra hotel nights.

3. Personal Safety

While Brazil is filled with welcoming people and vibrant communities, big cities experience petty theft, especially in tourist hotspots. Insurance helps replace lost valuables and important documents.

Case Study — First-Time US Traveler to Rio

Emma, a first-time solo traveler from California, arrived in Rio excited for Carnival. On Day 3, her phone was taken from her beach bag. Her travel insurance policy reimbursed her for the replacement and provided immediate assistance so she could access emergency contact tools and local guidance. Without insurance, the cost and stress would have doubled.

Sample Table: What Brazil Travel Insurance Includes

| Coverage Type | Typical Limit | Why It Matters in Brazil |

| Medical Emergency | $50,000–$500,000 | Private hospitals preferred by tourists |

| Trip Cancellation | Up to trip cost | Weather disruptions, illness |

| Lost Baggage | $1,000–$3,000 | Theft occurs in crowded areas |

| Travel Delay | $150–$250/day | Common domestic flight delays |

| Adventure Sports Add-On | Optional | Amazon tours, surfing, trekking |

Brazil travel insurance guide for first time travelers

First-time travelers to Brazil often face an overwhelming amount of information — vaccinations, safety planning, internal flights, climate differences, and cultural nuances. The best strategy? Keep your travel insurance simple, strong, and suited to Brazil’s unique geography.

Why First-Timers Need Travel Insurance More Than Experienced Travelers

New travelers may struggle with navigation, budgeting local currency (Brazilian Real), and managing unexpected events—lost passports, illness from new foods, or theft during crowded festivals. Travel insurance functions as a safety net, providing emergency support, translation assistance, and even embassy coordination.

Key Tip

First-time travelers should look for plans with at least $100,000 medical coverage and 24/7 global assistance.

Case Study — Canadian Traveler in the Amazon

Lucas from Toronto joined a guided Amazon river tour. He developed a severe allergic reaction from a bug bite, requiring evacuation to Manaus for treatment. The helicopter evacuation alone was valued at $7,000. His travel insurance covered the entire cost. Without it, the financial impact would have ended his trip early.

What First-Time Travelers Commonly Overlook

| Mistake | Result | How Insurance Helps |

| Assuming public hospitals are good everywhere | Quality varies | Private hospital access |

| Not planning around Brazil’s domestic flight delays | Missed tours | Compensation for delays |

| Carrying expensive items in crowded areas | Theft risk | Baggage/personal effects coverage |

| Booking Amazon/Foz do Iguaçu tours without coverage | Injury risks | Adventure sports protection |

Do i need travel insurance to visit brazil

Technically, no, Brazil does not require travel insurance for entry. There is no mandatory insurance rule similar to the Schengen visa system. However, experienced travelers, governments, and major travel organizations strongly advise it.

Why Insurance Is Highly Recommended

- Medical costs can be high.

Private hospitals, preferred by tourists, can be expensive without insurance. - Brazil’s cities are vibrant but have variable safety zones.

Petty theft and pickpocketing are common in crowded tourist areas. - Large country = lots of internal travel risks.

Inter-city flights, buses, boats, and remote adventures increase the chance of events needing coverage. - Weather variability causes delays.—-Rainstorms, Amazon monsoons, and seasonal winds often disrupt travel.

Government Travel Advisories Say the Same

| Country | Recommendation |

| United States | “Strongly recommended — particularly medical evacuation coverage.” |

| United Kingdom | “Crucial because of crime rates and the distance separating major cities.” |

| Canada | “The private healthcare system in Brazil can be costly; therefore, it is advisable to purchase travel insurance..” |

| Australia | “Essential for medical, theft, and weather-related disruptions.” |

Mini Story — UK Couple in Salvador

A British couple visiting Salvador had their luggage misplaced during a domestic flight from Rio. Their travel insurance reimbursed their clothing and essentials while the airline located the bags. The process was stress-free because they had coverage.

Why is travel insurance important for brazil travelers

Why is travel insurance important for brazil travelers

Brazil’s charm lies in its contrasts — bustling megacities, rainforest wilderness, vibrant beach culture, and high-energy festivals. With such variety comes unpredictability. Travel insurance is important because it fills the gaps travelers can’t foresee.

Top Reasons Travel Insurance Is Crucial in Brazil

| Risk | Why It Matters | Protection Provided |

| Health emergencies | Private hospitals are costly | Medical + evacuation |

| Theft | Common in crowded tourist zones | Baggage + personal items |

| Domestic flight delays | Brazil is huge; delays common | Delay benefits |

| Adventure activities | Surfing, trekking, Amazon tours | Sports coverage |

Expert Insight

“Brazil is one of the top destinations where travelers underestimate medical evacuation costs. A simple evacuation from a remote island or rainforest can exceed $10,000.” — Global Travel Advisor, 2024

United Arab Emirates Travel Guide Ultimate Tips 2025

Benefits of having travel insurance in brazil

Travel insurance turns uncertainty into control. Its benefits stretch beyond emergencies and include both financial and emotional protection.

Major Benefits

- Access to high-quality private care

Tourists prefer private hospitals, which are safer, faster, and cleaner. - Reimbursement for lost/stolen items

Brazil’s festivals and beaches are lively but crowded. - Coverage for canceled tours

Weather or illness can force unexpected cancellations. - 24/7 support— Language barriers can make emergencies stressful. Most insurers offer multilingual help.

Table: Benefits Breakdown

| Benefit Type | Why It’s Valuable in Brazil |

| Medical | Essential in major cities + rural zones |

| Theft | High-risk areas in Rio and São Paulo |

| Trip Delay | Domestic airlines frequently delayed |

| Sports Coverage | Surfing, snorkeling, jungle tours |

Expert Insight

“Tourists who explore waterfalls, rainforests, or long hiking routes in Brazil benefit most from policies with adventure coverage. Injuries here can occur even on guided tours.”

Brazil safety issues and insurance needs

Brazil is lively, welcoming, and culturally rich — but like any major travel destination, it comes with safety considerations. Understanding these helps you choose the right insurance.

Common Safety Issues

| Issue | What Happens | Insurance Needs |

| Petty theft | Phones, bags stolen in crowds | Theft + personal effects |

| Illness | Stomach bugs, heatstroke | Medical coverage |

| Outdoor injuries | Falls, bites, accidents | Adventure add-on |

| Floods/Weather | Cancelled tours, flight changes | Trip delay/cancellation |

Realistic Travel Example

During Carnival in Rio, large crowds create perfect conditions for pickpockets. Having insurance ensures replacements and quick support if documents or valuables go missing.

What does brazil travel insurance cover

Brazil travel insurance generally covers medical emergencies, evacuation, trip delays, lost baggage, theft, accidental injuries, and — depending on the plan — adventure sports or high-risk activities. Not all policies are equal, but most offer a comprehensive base package.

Typical Coverage Includes:

- Emergency medical treatment

- Emergency evacuation (crucial for Amazon or remote area travel)

- Hospitalization

- Trip cancellation/interruption

- Baggage loss or delay

- Travel delay reimbursement

- Flight connection issues

- Theft (documents, electronics, personal items)

- 24/7 assistance services

Checklist: What to Look For

- Minimum $100,000 medical coverage

- Evacuation + repatriation

- Baggage coverage ($1,000+ recommended)

- Trip protection (in case of weather disruptions)

- Theft coverage

- Adventure activity coverage if needed

brazil travel medical insurance coverage details

Brazil travel medical insurance coverage details

Medical coverage is the most important part of Brazil travel insurance. Brazil’s private hospitals offer excellent care but can charge high rates to foreigners.

Medical Coverage Usually Includes:

- Doctor visits

- Hospital stays

- Emergency room treatment

- X-rays, scans, blood tests

- Ambulance transportation

- Prescription medication

- Evacuation to the nearest suitable hospital

- Repatriation back home if medically necessary

Recommended Limits for Tier-One Travelers

- US/Canada: $250,000–$500,000 (high medical costs at home justify higher limits)

- UK/Australia: $100,000–$250,000 is usually sufficient

Adventure sports coverage brazil travel insurance

Brazil is an adventure playground — surfing in Florianópolis, trekking in Chapada Diamantina, kayaking in Paraty, Amazon excursions, hang gliding in Rio. These activities often require adventure or sports add-on coverage.

Activities Usually Covered with the Add-On

- Hiking and trekking

- Snorkeling and diving

- Surfing

- Ziplining

- Jungle tours

- Canoeing/kayaking

- Hang gliding

Why This Matters

Many standard travel policies exclude injuries from high-risk or adventure activities. If you get injured in a rainforest trek or surfing lesson, you may not be covered without this add-on.

Cost of travel insurance for brazil trip

Maria, a US traveler from Florida, booked a two-week trip to Rio + Iguazu Falls. She compared prices from three popular insurers.

| Insurer | Trip Cost | Policy Type | Price |

| A | $2,800 | Comprehensive | $112 |

| B | $3,000 | Mid-Tier | $86 |

| C | $2,900 | Premium | $134 |

Maria chose the premium plan because it included adventure coverage for Iguazu and higher medical limits. Her peace of mind was worth the extra $22.

Daily travel insurance rates for brazil travelers

Daily insurance rates for Brazil typically range from $3.50 to $7.50 per day depending on age, coverage level, and travel activities. Travelers from the US and Canada often pay slightly more due to higher medical coverage suggestions.

| Traveler Origin | Daily Average |

| US | $5–$7.50/day |

| UK | $4–$6/day |

| Canada | $5–$7/day |

| Australia | $3.50–$6/day |

Takeaway: Brazil remains one of the more affordable destinations for comprehensive coverage.

How to select the most suitable travel insurance for Brazil

Choosing the best Brazil travel insurance means balancing cost, coverage, and your itinerary. Start with medical needs, then add protection for theft, adventure activities, and trip disruptions.

Key Tips

- Choose medical coverage of at least $100,000

- Look for emergency evacuation and repatriation

- Check the insurer’s maximum theft coverage for electronics

- Add sports coverage if doing Amazon, hiking, or water sports

- Compare cancellation coverage if traveling during rainy season

A strong policy should feel like a safety net, not an expense. You’ll know it’s right if it protects the parts of your Brazil trip that matter most.

What to look for in brazil travel insurance policy

A good Brazil travel insurance policy should include strong medical benefits, theft protection, trip cancellation, and adventure sports options. Look at policy limits, exclusions, and customer service ratings.

Checklist

- Medical: $100k–$500k

- Theft coverage: $1,000+

- Trip delay: $150/day minimum

- Baggage loss: $1,000–$3,000

- Adventure coverage optional

- 24/7 global assistance

Takeaway: Brazil’s beauty is worth exploring—choose a policy that protects your journey fully.

FAQ

Q. What travel insurance do I need for Brazil?

You need a comprehensive travel insurance plan that includes medical coverage, emergency evacuation, trip cancellation, theft protection, baggage coverage, and optional adventure sports coverage depending on your activities. Medical coverage should be at least $100,000 for most travelers, though US and Canadian travelers may prefer $250,000–$500,000. Because Brazil is large, with different terrains and a mix of urban and remote locations, insurance with strong evacuation protection is especially important. Plans with coverage for lost or stolen electronics are also valuable because petty theft can occur in crowded tourist zones. Overall, choose a policy that matches your itinerary — beach trips, Amazon excursions, and city stays each have unique risks.

Visit Our Social network